SEC charges US trader for allegedly abusing Twitter to pump cannabis penny stock prices

The US Securities and Exchange Commission (SEC) has charged a Californian trader for allegedly using Twitter to hype up stocks before dumping them for a profit.

The charges, unsealed on Monday and filed in federal court in the Central District of California on March 2, accuses Andrew Fassari of fraud through the spread of “false and misleading” information.

SEC has also obtained an emergency asset freeze and other emergency relief.

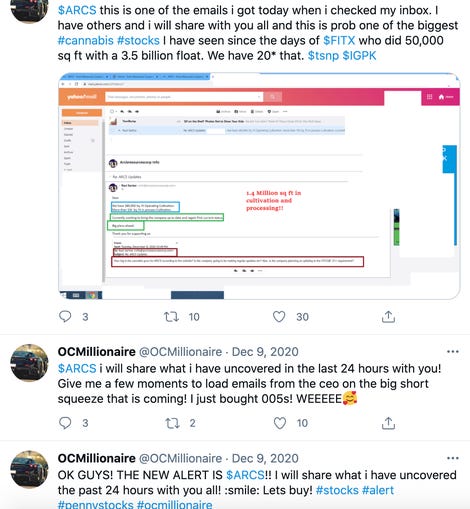

According to SEC, Fassari, under the Twitter handle @OCMillionaire, used the microblogging platform to allegedly spread false tips relating to the stock of a company, Arcis Resources Corporation (ARCS).

The Twitter handle is followed by roughly 13,000 users and was active as of March 8, 2021.

SEC’s complaint says that on December 9, Fassari began purchasing over 41 million shares in the Nevada company before touting the stock on Twitter.

Among the claims, documented in over 120 messages referencing $ARCS, was the expansion of operations, a CEO that had “big plans” for the company, exciting news was on its way, and the idea that investment could be a “life-changer.”

The US regulator alleges that while the share price rocketed by over 4000%, Fassari then sold his stake and secured profits of over $929,000.

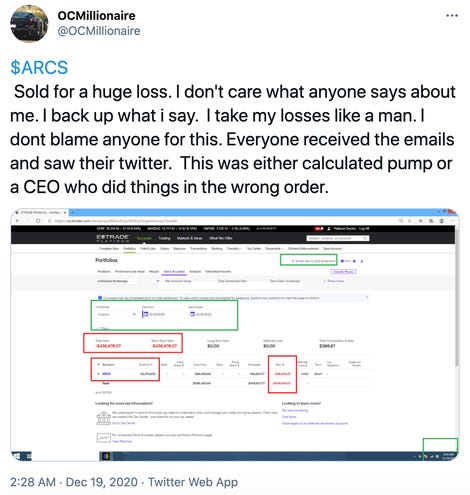

On December 19, Fassari posted a screenshot to Twitter claiming that he had sold for a massive loss. The message read:

“$ARCS / Sold for a huge loss. I don’t care what anyone says about me. I back up what I say. I take my losses like a man. I don’t blame anyone for this. Everyone received the emails and saw their Twitter. This was either [a] calculated pump or a CEO who did things in the wrong order.”

However, some Twitter followers have questioned the authenticity of the trading screenshot.

On March 2, SEC issued a temporary trading ban on ARCS securities (.PDF).

“We allege that Fassari profited by using social media to deceive investors,” commented Melissa Hodgman, Acting Director of SEC’s Division of Enforcement. “The SEC is committed to protecting investors by proactively monitoring suspicious trading activity tied to social media, and by charging those who use social media to violate the federal securities laws.”

The regulator is seeking a permanent injunction, disgorgement, prejudgement interest, and a civil penalty under charges of violating the antifraud provisions of federal securities law.

Speaking to Reuters, a lawyer acting on Fassari’s behalf said, “it appears Mr. Fassari has been hit with fallout from the GameStop, Robinhood, Reddit controversy.”

Around the time when GameStop (GME) shares skyrocketed and some retail investors jumped on so-called ‘meme’ stocks, SEC issued an advisory warning of the risks associated with stock trades pumped on social media.

SEC acknowledged that many may jump on stock options discussed across social media platforms, news aggregators, research websites, and forums, but cautioned that “following the crowd may lead to significant investment losses.”

In March, SEC charged a number of individuals allegedly involved in an Airborne Wireless Network pump-and-dump stock scheme. The agency claims that the publicly-traded firm’s controlling parties were concealed and cash was spent on hyping the stock, only for major holders to dump their stakes — defrauding other investors out of $45 million.

Previous and related coverage

Have a tip? Get in touch securely via WhatsApp | Signal at +447713 025 499, or over at Keybase: charlie0

READ MORE HERE